By Aly Sterling, President & Founder, Aly Sterling Philanthropy

By Aly Sterling, President & Founder, Aly Sterling Philanthropy

Foundations are one of the most powerful philanthropic vehicles for charitable families. From big names like the Ford Foundation to smaller-scale grantmaking organizations you can find next door, family foundations all share one common goal: to use their resources, expertise and networks to address pressing social issues and make a positive impact.

Through strategic grantmaking, foundations accounted for 21% of all contributions given in 2023, amounting to $105.21 billion to nonprofits all over the country. If your family is interested in catalyzing change within your community and beyond, you’ll need a strategic plan to align your charitable initiatives with your mission and maximize the use of your funds.

In this guide, we’ll cover three strategic planning steps to secure your foundation’s future and cement your family’s philanthropic legacy.

1. Assess your current state.

Your foundation has likely made strides in your community, such as providing scholarships to college students or issuing grants to deserving charities, but there’s always room for improvement. The first step to building your strategic plan is examining your foundation’s current state and pinpointing how you can maximize your impact.

However, rather than conducting this process in-house, you’ll want an unbiased philanthropic advisor to bring a fresh perspective to your strategic planning. Aly Sterling Philanthropy explains that a philanthropic advisor is an expert consultant who supports individuals and families in developing a purpose-driven strategy for their charitable giving.

A philanthropic advisor will kickstart the strategic planning process by meeting with your family foundation’s leaders to learn more about your history, infrastructure, core programs, grantmaking procedures and vision for the future. This process might also involve collecting additional insights by surveying stakeholders, such as:

- Board of trustees or directors

- Grantees and beneficiaries

- Current and past annual, legacy and major donors

- Community members

It’s important to hear diverse perspectives, so invite a variety of different stakeholders to interviews with your philanthropic advisor. This way, your advisor can collect a balance of both positive feedback and constructive criticism, pointing to ways your foundation can grow and improve.

2. Align your goals and establish priorities.

Now that your advisor has taken a deep dive into where your foundation stands and where you want to be in the future, it’s time to establish your biggest priorities.

For example, let’s say your philanthropic advisor found that your foundation struggles with budgeting, and, as a result, has limited funds to allocate towards your grants. This would mean that reassessing your budget, including how much money you allocate to expenses like grants, marketing costs and employee salaries, would land at the top of your priorities.

Or, maybe your family foundation’s leaders all have different visions for the future and struggle to agree on which causes to give to. Revisiting your purpose and clarifying your mission statement would then be a top priority so you can focus your charitable giving on the initiatives that truly matter to your family.

Regardless of what your areas of improvement are, understanding your biggest priorities will make it easier for your leaders to say “yes” to the philanthropic activities that push forward your mission and “no” to the ones that don’t. This clearer sense of direction will help to streamline internal operations, rally your team around your mission and overall make it easier to bring your goals to fruition.

3. Develop a plan of action.

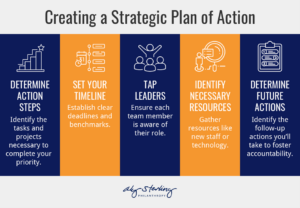

Once your leaders have a firm foundation of your areas of improvement and most pressing priorities, it’s time to consolidate these ideas into a plan of action with the help of your philanthropic advisor. A successful plan of action will include the following elements:

Ensure your family foundation’s strategic plan of action includes these elements, repeated below.

- Action steps: What tasks or projects are necessary to address your biggest priorities? For example, if a family member steps down and leaves their leadership role vacant, you’ll need a philanthropic advisor to guide you through succession planning, and, if necessary, lead board training sessions and facilitate board meetings to strengthen your leadership.

- Timeline/milestones: To foster accountability and keep everything on track, your foundation will need to set up a clear timeline for meeting your objectives as well as set key performance indicators (KPIs) and benchmarks to measure your progress. For example, your philanthropic advisor will support your grant management by monitoring the steps grantees have made since being awarded funding and the subsequent impact in the community. This will help you to measure the efficacy of your grantmaking systems and protocols.

- Leaders: Clearly define the roles and responsibilities for each of the tasks and projects that will need to be executed. For many family foundations, it might be the family members themselves in charge of seeing projects through, while for others, it could be the board of directors or trustees, program officers, grant manager or other administrative personnel.

- Necessary resources: Pinpoint the specific resources you’ll need to meet your priorities. Along with the ongoing consultation of an expert philanthropic advisor, you might find that you’d benefit from hiring additional staff members to fill in gaps in your infrastructure or new technology to streamline operations. For example, Fionta’s guide to grantmaking recommends investing in grants management tools with communication, application management and reporting tools to easily issue and track your grants.

- Future/ongoing actions: Determine any additional actions your foundation will take to make sure your projects are followed through. For example, you might host regular check-in meetings to assess progress and make adjustments to your strategies as needed.

With a philanthropic advisor, you’ll have a trusted consultant to lead you through each step of this process, including exploring your philanthropic motivations, creating actionable strategies and measuring outcomes.

As you search for a philanthropic advisor, make sure to evaluate the specific services they offer. This will help you find the perfect partner for your needs and avoid investing too much time in considering advisors who don’t have the expertise and background you’re looking for.

For instance, if you’re interested in revamping your foundation’s communication plan, but a philanthropic advisor doesn’t list communications as one of its core services, you can take this one off the list.

It can also be advantageous to consider the broader services a philanthropic advisor offers. For example, if you’re interested in restructuring your grantmaking procedures and partnering with new charities, you’d likely benefit from working with an advisor who also offers fundraising consulting services to nonprofits. Their pre-existing connections with charities may make it easier for your foundation to find vetted causes to support, enhancing your overall impact.

With a strategic plan, your private foundation can develop a cohesive framework for family members across generations to engage in philanthropic giving. Whether you’re hoping to revamp your grantmaking strategies or revisit your guiding principles, a philanthropic advisor can help you chart the course to success.

Visit The Giving Institute’s member directory for a complete list of firms providing expert counsel to charitable organizations like nonprofits and foundations to kickstart your search.